Lately, I’m starting to gain a glimpse of understanding into how the various cable news talking heads might feel. The other day, I tallied my time and realized I’m on web conferencing roughly 70% of my day. As a consultant, pre-pandemic, I was working remotely roughly half the time. But being on camera for most of the day has added a new dynamic to my work.

I know I’m not alone, as my colleagues and clients share similar stories. And the discussion around the LinkedIn headshot change from North Carolina mother Lauren Griffiths shows we’re all trying to navigate how to be authentic and productive in a strange new work world. Lauren admitted that she tried to conform to the old LinkedIn norm—a professional headshot—but the pandemic prompted her to be more authentic: “I’ve witnessed and read enough on authentic leadership to know that being genuine and vulnerable will get you a lot farther in your career than a glossy headshot.”

Remote is here to stay

For many of us—and especially for wealth managers—this deeper foray into remote work is a change.

Recent Accenture research from spring of this year found that 45% of financial advisors were meeting with their clients mainly in person, while 55% were doing so remotely (25% via phone, 30% via video conferencing).

I would expect, as the pandemic continues, the remote numbers will rise.

I still talk to too many wealth advisors who wonder what “normal” might look like when the crisis has passed. And I tell them—this is now our normal. Remote is here to stay.

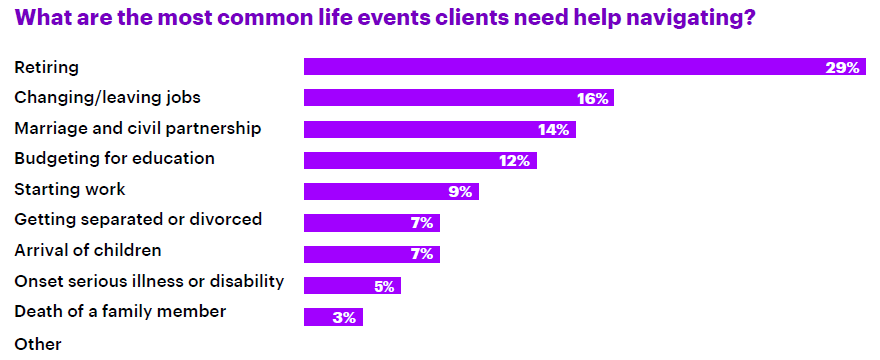

Is that challenging? Possibly. Beyond becoming comfortable with the technology, wealth managers need to find a way to infuse remote client conversations with the human touch. After all, they’re discussing some very personal and emotional topics. From retirement to leaving a job, their children’s education to marriage, advisors are in the thick of life with their clients. Eight out of 10 (81%) say they hold meetings with clients to help them navigate complicated family dynamics. Doing that remotely becomes an added challenge.

Source: Accenture Research

I have a few thoughts on what advisors need to do to get remote counseling right. The good news is—technology is proving to be more help than hindrance.

It’s not just about more collaborative capabilities. It’s about richer collaborative capabilities.

Pulling off a web conference without a glitch is good—but enriching that web conference with the ability to pull up reports and collaborate real time with clients on adjusting scenarios is great. Wealth firms need to invest in their platform and advisor capabilities, integrating CRM beyond just the basic contact information and investment reporting. Being able to incorporate video and engagement tools to co-build a goals-based plan, or model different market scenarios, spell the difference between sharing some flat spreadsheets and having a real, immersive conversation.

Clients expect on-demand engagement. And they want a personalized experience.

One-third of the financial advisors we surveyed said their clients are “moderately financially literate.” We can interpret this to mean they know enough to ask questions, push in areas like ESG investing, and actively participate in scenario planning. If remote is the go-to option for the foreseeable future, advisors will need tools that can deliver a personalized experience remotely. That means the capability to access complex reporting and translate it into easily understandable formats—formats that play well in a video call.

Wealth advisors need rich data and worthy platforms.

Remember when the iPhone was introduced? Apple didn’t roll it out because consumers said they needed a device that would become a constant companion. Rather, Steve Jobs saw possibilities for innovation that consumers didn’t—and he led them into his vision. I see a similar situation with advisors and wealth platforms.

Our research shows an amazing 70% of wealth managers say their tools and technology allow them to be “perfectly adequate” at their job.

As firms move the needle on innovative client platforms, I think we’ll see that these advisors may not have realized what they were missing. There’s a massive need to harvest data, using Artificial Intelligence (AI) and analytics to create personalized insights based on it.

AI will likely continue to change the wealth management field; we’ve only just begun to tap into its potential. As the industry moves more toward virtual advice, we have an opportunity to gain an entirely different understanding of clients at scale. Not only should that drive better personalization, it is expected to drive better service in each client segment as we better understand the needs of different types of clients. But if your platform isn’t up to the challenge, your firm won’t be able to keep pace.

It is time to “get real” with remote financial advice.

COVID-19 has certainly made all of us appreciate face-to-face interactions more than ever. But it’s also highlighted how efficient and convenient remote advice can be. Given that remote capabilities are an ever-increasing part of the advisor mix, I think it’s time for all of us in the industry to “get real” with remote. I’m helping wealth firms do just that as I do the same in my own professional life.

I think Lauren Griffiths was on to something. As wealth advisors strive for that same authenticity in remote work, let’s give them the digital tools that could help foster a rich client relationship.

If you’d like to learn more about our financial advisor survey results, visit Financial Advice Reimagined.