Our recently published Asia wealth management report focuses on two major areas for firms: The importance of mobile as a channel that, our research shows, wealth management firms can greatly improve; and the evergreen—and so far unanswered—question of relationship manager (RM) productivity. Both areas link directly to firms’ primary ambition in the region: future growth.

Growth ambitions collide with relationship manager realities.

Why is that important? Almost without exception, all firms we surveyed expect their RMs to drive their future growth—even though RM productivity is currently relatively low (as RMs spend only ~40% percent of their time on core activities) and even though revenue per RM is likely to drop from US$2.4m last year to around US$2.2m by 2026.

It’s a case of ambition running up against reality, which is why it is easy to conclude that most firms won’t achieve their growth goals—unless, that is, they solve the challenge of RM productivity. While it’s important to acknowledge that RMs’ productivity failings are not the fault of RMs per se, it’s also critical to identify where the problem really lies—and that’s often the way firms have defined the RM role.

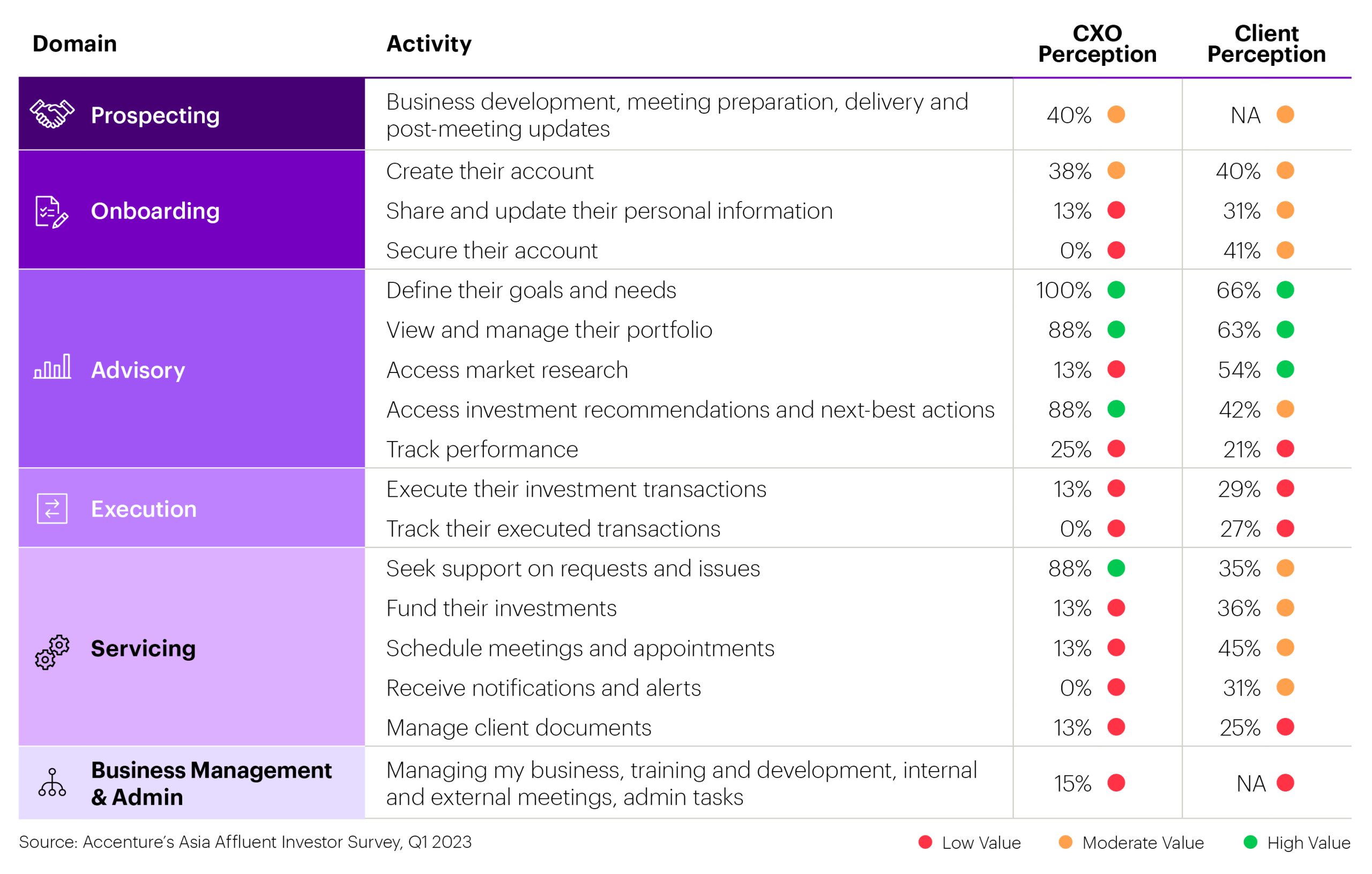

As our research shows (see graphic), RMs—firms’ costliest resource at 60-70% of the annual cost base according to our discussions with the leaderships of 20 banks in the region—perform too many tasks, and many of those (the red circles) even add little or no value for their customers. Others from the rest (the yellow circles) add only moderate value. The results of this setup are inefficiency and client dissatisfaction, with half of clients stating in our research that they are unhappy with their RMs’ service.

Two other findings are also important when thinking about the RM role: First, clients see high value (the green circles) nearly only in advisory, and there is just moderate or low perceived value in RMs’ other tasks. Second, about three-quarters of RMs’ time is spent on non-value-add activities. Clearly, it makes not much sense for RMs to spend the bulk of their time in the ways that they do today. There must be a better way.

Mapping a better RM path

In my mind, firms need to transform the RM role, and ensure it focuses primarily on the topics that add value for their customers. But how to do that?

Step one would be a fundamental redesign of the RM role to bring it back to basics. This starts by asking what RMs should be doing, based on value-add and regulatory requirements. If tasks don’t tick either of those boxes, then as a matter of principle they should not be part of the RM role.

At the end of this initial step, some tasks will remain with the RM. The rest will be either reduced (most significantly in areas like onboarding, execution, servicing, and business management) or removed entirely from the RM remit (they might be pushed to specialized departments/staff). This could help to improve RMs’ productivity dynamic and boost client satisfaction.

Pursuing such a disruptive approach would also move firms much closer to their vaunted growth goals by freeing up RMs to spend more time on revenue-generating activities like advisory and prospecting.

Remove, reduce, retain—now what?

Whether you remove, reduce or retain RM tasks, automation also has a role to play, with generative artificial intelligence (Gen AI) becoming a key resource. While the logic of deploying Gen AI to support the RM role (and other functions in wealth management) is clear, getting started can seem daunting. The following three steps could be helping to determine possible entry points:

- Step 1: Identify use cases aligned to client “moments of truth”—those activities that have a significant impact on a client’s decision to perform an action and that generate the greatest business impact.

- Step 2: At the same time, identify internal use cases that enrich the employee experience (vital to retaining RMs) and generate productivity—but that do not necessarily involve clients.

- Step 3: Prioritize value over complexity to generate quick wins and momentum and build a roadmap for cascading value realization.

Despite the wealth of potential Gen AI use cases that are out there, firms should be pragmatic and prioritize their approach. They need to also be aware of constraints in areas like regulation and risk management, and practice Responsible AI (the practice of designing, developing, and deploying AI with good intention to empower employees and businesses, and fairly impact customers and society).

One area that obviously needs to be looked at closely when thinking about leveraging Gen AI is technology. Some thoughts that come to mind are around the following topics:

- Infrastructure: Determine the infrastructure and computational requirements to support the large language models (LLMs) that underpin Gen AI. Cloud infrastructures might be a requirement for some Gen AI use cases.

- Accuracy: Manage hallucinations that can lead to plausible—but flawed—outputs as Gen AI could pose new challenges for data by way of bias and potentially over-confident responses.

- Information security: This includes areas like data privacy, data residency, and encryption, so consider a robust testing approach that delivers reliable, consistent and accurate information.

Transforming for growth and client satisfaction

Having built-out in the past month a raft of Gen AI use cases and prototypes that focus on Asian wealth management, I’ve concluded that the only limitation to identifying suitable use cases is one’s imagination. One interesting example that I came across recently, is deploying Gen AI to provide timely, relevant investment and other content to clients, which would address an important client complaint that our research identified: clients view content as a key differentiator, yet most are unhappy with what they get today—which correlates strongly with their satisfaction levels with their firm.

Overall, a logical place to start is to pilot Gen AI with a small number of high-value but lower-risk use cases, such as prospect identification or, as with the example mentioned above, improved dissemination of already-approved research and similar content.

After that, firms could branch out to client use cases. This is best done by focusing on the moments of truth across the typical wealth journey—those activities that have a significant impact on a client’s decision to perform an action that drives adoption, conversion, deepening or retention, and which in turn affect the bank’s revenue, for instance, or its client adoption or attrition rates.

Ultimately, firms hesitant to revamp the RM role, including by making the leap to Gen AI where suitable, should consider that their competitors are already taking steps in both areas. Delaying means falling behind—and brings the risk of putting their growth goals even further out of reach.