In our recent report, Empowering relationship managers: The tools they need to succeed, we made the point that wealth management firms in Asia have set ambitious growth goals that most are unlikely to meet—unless, that is, they also tackle the productivity challenges faced by their relationship managers (RMs).

We also outlined a range of actions that wealth management firms should take to help their RMs deliver. I won’t list all of these here, but it’s worth noting that the research for that paper was carried out in January 2022, when markets were stronger. Today, in a more volatile and uncertain environment, the role of the relationship manager is becoming even more important. As more clients might have questions on their holdings and what to do next, the core of a relationship manager’s role—spending time with clients and providing insights—needs even more strengthening. But what firms need to do to help realize this has not really changed. Let me explain why I believe this is the case.

A quick recap based on numbers

Eight months ago, we found wealth management firms in Asia wanted to nearly double assets under management (AUM) by 2025 from 2021 levels and grow revenues nearly 60 percent. To achieve that, we calculated, firms need to achieve a 14 percent compound annual growth rate (CAGR) for AUM and 12 percent for revenues. Current market conditions make attaining those growth rates—which were somewhat challenging already—much harder.

At the same time, we made clear in our report that success also requires that firms need to ensure that RMs’ average revenue in the region, which is about US$1m according to our research, grows by far more than the four percent CAGR firms have planned. And, as we also noted, RMs lack the tools they need to perform their key roles.

In summary, firms’ growth ambitions have already run up against the capability of RMs to deliver what’s needed, with market conditions now delivering a further blow—not only to firms’ goals but also to the time constraints, RMs are facing anyway. It’s clear, then, that wealth management firms need to act.

Raising productivity is the answer

The good news is that what firms need to do hasn’t really changed much. Our research found that at wealth management firms in our survey:

- Half of RMs’ time each week is spent on non-revenue-generating activities like administration, non-client meetings and trade execution.

- A typical RM uses an average of five tools or applications for each key activity.

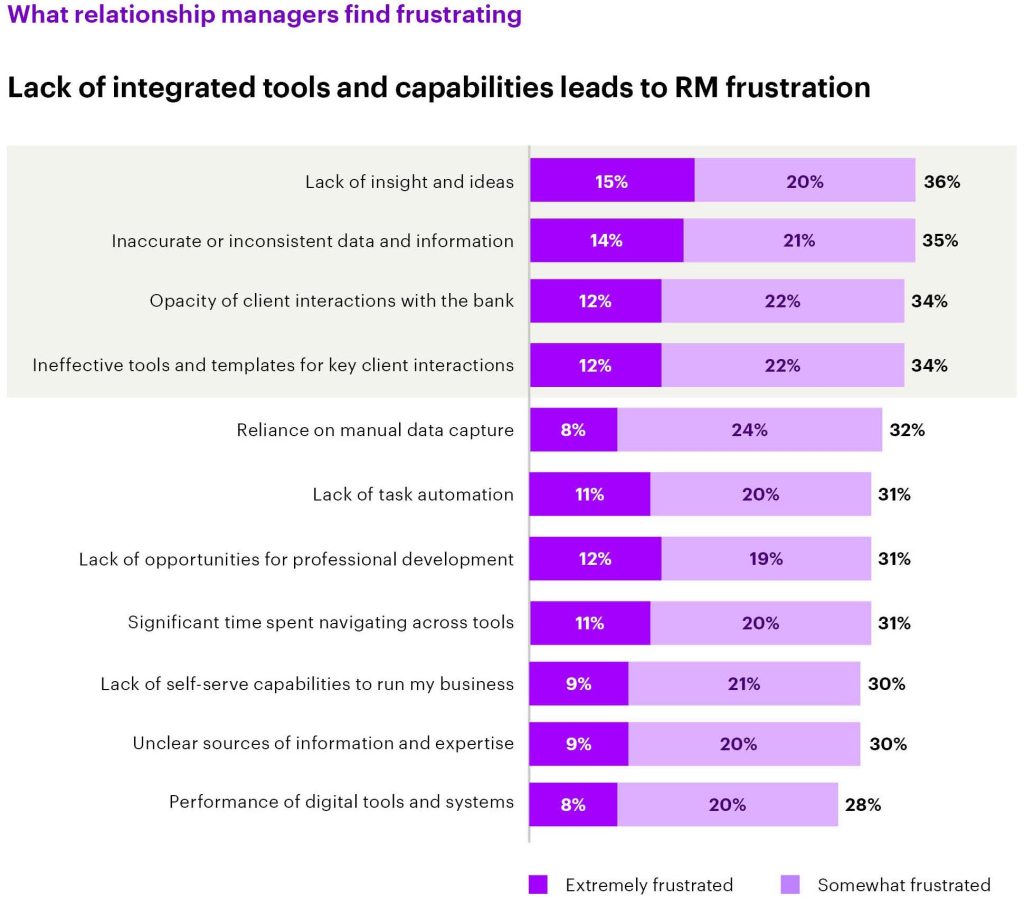

This is highly inefficient, with the lack of integrated tools feeding into further RM pain-points (see Figure 1).

Logically enough, a core part of the solution is to boost RMs’ productivity and time to be spent with clients by fixing what’s wrong. Once again, there is good news: RMs know what they need. Nearly 80 percent of respondents in our RM survey say the solution is a one-stop platform, or cockpit, that brings together all underlying RM capabilities in a single place. In this way, they can use a single tool across practice management, prospecting and onboarding, advisory, execution and order management, and client servicing.

The decision for firms is then whether to build a bespoke cockpit, adopt a third-party customer relationship management (CRM) solution or set up a specialist digital wealth solution. Our RM report goes into much more detail about each option.

As customer expectations will only continue to rise—somewhat also regardless of market conditions—enabling RMs and giving them what they need is key. And would only become more important going forward, as the demand for these linchpin staff is likely to rise in the coming years. Hence, wealth management firms need to act and give their RMs what they need—in the best interest to achieve their customer, their RMs and thus their firms’ goals.