What drivers are shaping the future of wealth management and advice across Europe? Our recent research study, Creating the wealth management firm of tomorrow, conducted jointly with PIMFA aimed to provide some answers. In the underlying survey, we asked C-Level industry executives in eight European countries for their views on current industry changes, and where and how their firms would need to reinvent themselves to be future-ready. In return, survey respondents highlighted four drivers that are shaping the future ready wealth management firm of tomorrow. Three of them were:

- industry consolidation / cross-sector competition for clients

- the war for talent

- the need for organisational agility to execute change at pace

The other? You won’t be surprised to hear that it’s technology in all its forms—a view expressed by 88% of the survey respondents. And they increasingly see technology not just as an agent of change, but also as a key enabler across everything wealth managers do.

Emerging technologies coming to the fore

Technology’s growing importance is reflected in a number of interrelated industry shifts. One is shorter innovation cycles. Another is that the adoption of digital is today moving beyond efforts to improve back-office efficiency. It is expanding rapidly into the front office with a view to help boost growth and client-centricity—an advance encouraged by the forced move to remote interactions during the pandemic.

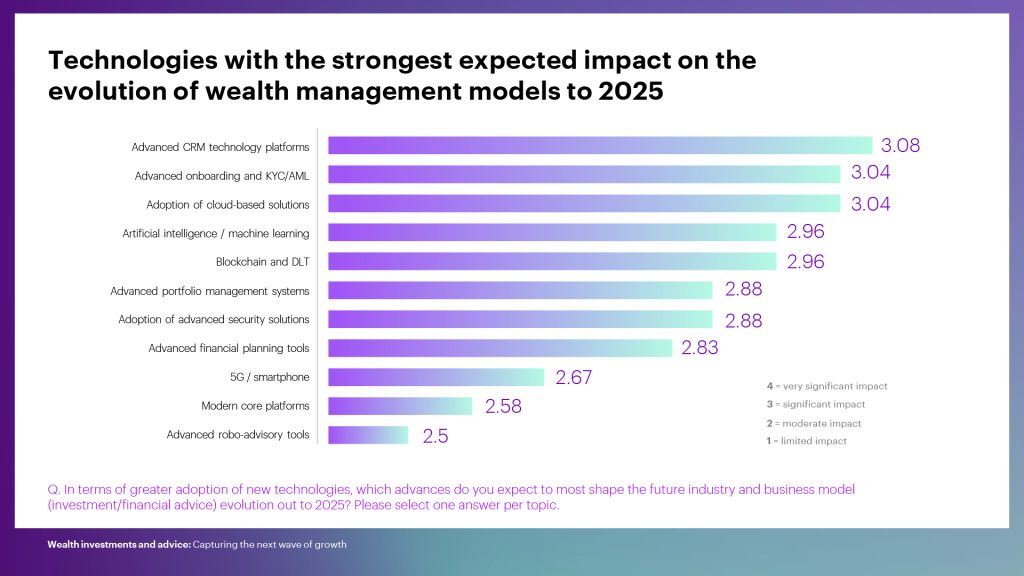

So, what technologies are leading the charge to wealth management’s digital future? As the chart below shows, three stand out. Over 70% of respondents expect Advanced Customer Relationship Management (CRM), Advanced Onboarding/KYC/AML and cloud solutions to reshape the industry.

It isn’t hard to see why. In both CRM and onboarding, advanced digital capabilities could help firms address many of the current pain points in the client and advisor experience. Through adopting artificial intelligence and machine learning, a more personalised and predictive approach could be offered, driving in return more relevant and timely client interactions at key points of need over clients’ life stage evolution. By helping advisors achieve a better balance of hybrid human and technology interactions and deliver a better, digitally-supported service, those solutions free up advisors to focus on higher-value tasks and let clients self-serve for rather lower-value-adding activities which could drive efficiencies.

But it’s also a call to action as firms admit they have to go further in some key capability areas in the future—such as scaling the provision of advice, deepening their understanding of clients to better target key existing and new clients, and proactively educating and alerting clients to risks and opportunities around their financial goals. Firms also know that by addressing these needs with the right blend of human talent, technology and ingenuity, they’ll be able to tackle their advisor talent shortages.

Cloud and Artificial Intelligence—opening the way to reinvention…

The other game-changing tech capability in our respondents’ top three is cloud-based solutions. Its high-ranking underlines cloud’s increasingly pivotal role—in combination with other leading-edge technologies— as a core driver of enterprise reinvention at speed. Here wealth managers are often behind their counterparts in other sectors of financial services.

Combining cloud with artificial intelligence (AI) cannot just offer an improved, modern technology infrastructure—but also one that could deliver 360-degree business value through becoming data- driven, achieving faster product and solution innovation, higher scalability and better security. Furthermore, it also provides opportunities to e.g., leverage green cloud to reduce carbon footprint and energy consumption—which might in turn be contributing to clients’ perception of a wealth manager as a responsible business.

AI and Machine Learning (ML) are already being used to streamline some aspects of portfolio management and prospecting for new clients. But their adoption could increase further: Powerful data driven AI use cases may include solutions such as a “wealth predictor” that mines multiple external data sources to identify the moment when e.g., entrepreneurs will sell their business and might need wealth management services so the wealth manager could contact this client at precisely the right time. True, there are important considerations around AI, such as the need for it to be explainable and free from bias—and these should be thoughtfully addressed through appropriate data driven strategies. The overall trend (and some more thoughts around it) is also highlighted by my colleague Keri Smith in a recent blog on how advancements in AI could help the wealth management industry even more.

…and ultimately to the metaverse

What’s more, wealth managers equipped with an agile, scalable and smart cloud infrastructure should be well-placed to harness many other future technologies that are still in the early stages of evolution. As Accenture’s Technology Vision 2022 highlights, the rise of Web 3.0 and the “internet of place” is enabling the emergence and expansion of the “metaverse continuum”—in turn creating new future vistas of opportunity for the wealth industry.

Looking forward, opportunities in the metaverse can expand even further, as technologies like blockchain and NFTs could provide an “internet of ownership and identity” that will accelerate the metaverse’s commercial evolution–again foreshadowed in Accenture’s latest Technology Vision.

Technology implementation: becoming collaborative—and agile

Looking across all these advances, what shines through is that the technology that enables the wealth manager of tomorrow will be very different from the monolithic systems of past. It’s a future of myriad different technology solutions, use cases and ecosystem partners—one where the more traditional approach of leaving IT management solely to the Chief Information Officer (CIO) of a wealth management firm might quickly run out of road. As technology becomes ever more central to business advantage, innovation and value, the CIO will increasingly need to collaborate with the wider C-suite, and together with chosen ecosystem partners, they need to be acting as educators and guides as all areas of the business navigate from their current state to become future-ready.

Embarking on the journey

The overall message? In an era of ever stronger cross-industry competition and compressed change, the challenge facing all wealth managers is to decide which business driven technology capabilities they need today—and what capabilities and good practices they’ll need in the future. Only then can they map out a responsive reinvention and compressive change journey. A journey guided by an understanding of which combination of technologies, ecosystem partners and capabilities will best deliver their ambitions for business value and growth.