The defined contribution (DC) industry in the US has an important role to play in helping to solve a multitude of future retirement challenges faced by many Americans. However, the attractiveness of the recordkeeping business is waning for many providers: administration fees have continued to decrease, and the value that was once captured in fund advisory has been largely eroded with the rise of passive products. Additionally, many recordkeepers face scrutiny for their proprietary default fund placement, particularly in the large plan market.

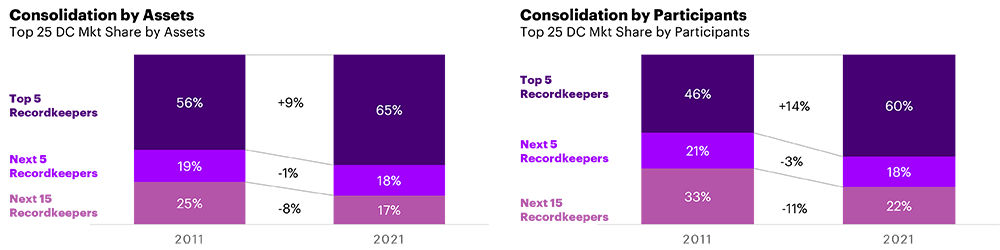

It’s no big surprise that we have witnessed a rapid consolidation of retirement recordkeepers over the past decade. Nearly half of the largest 20 DC recordkeepers by assets under administration (AUA) in 2011 have either merged or been acquired, including larger firms like Prudential and Wells Fargo. As a result, the top five recordkeepers have gained an astounding nine percentage points of market share in AUA and 14 percentage points of market share of participants between 2011 and 2021.

Consolidation in the retirement recordkeeper market

Source: Accenture analysis

How consolidation drives scale in recordkeeping

This consolidation in the industry is partly driven by the search for scale that can create two significant advantages in today’s increasingly competitive retirement recordkeeping market. The first and most obvious benefit of scale is the enablement of a cost-advantaged operating structure, resulting in a lower cost per participant. With a portion of plan sponsor and participant servicing (e.g., onboarding, money movement) requiring manual processes, leveraging scale can deliver efficiencies and help drive operating margins.

The second advantage of scale is that large recordkeepers usually can more easily afford the significant investments in capabilities needed for a rapidly evolving retirement value proposition. For instance, they can invest in digital technologies, analytics and artificial intelligence based capabilities to help further decrease business and data risks, and drastically reduce overall operating expenses. They also could invest in the next generation of financial wellness and advice offerings needed to better engage their participants.

Obviously not every retirement recordkeeper can achieve scale, which raises questions about how smaller recordkeepers could augment their ability to thrive despite the market challenges.

Ways to compete if you don’t have scale

We believe that there are three strategic models that could offer a path to compete effectively even without scale.

- The first is large plan specialists. Large and megaplans typically have significant switching costs for the sponsor, mainly attributable to unique plan design features and customized servicing requirements which makes provider changes relatively unattractive. Large plan specialists could also be less attractive acquisition targets for scaled players given their larger plans are more likely to bid the business when forced to undergo a recordkeeper transition.

- The second model is on the other end of the spectrum. Small plan specialists are often able to more efficiently serve a large number of very small plans than traditional recordkeepers. In fact, some scaled recordkeepers outsource their small plan services to other recordkeepers not wanting to deal with the servicing and associated costs small plans can bring. In addition, these small plan specialists have in many cases protected distribution channels such as payroll services that scaled players have yet not been able to disrupt.

- The third strategic model focuses on recordkeepers outside of the 401(k) market, and instead allows them to differentially serve the 403(b) or 457 plan space. These product specialists have some unique competitive advantages within their niche market segments, attributed to their understanding of the specific needs of plan sponsor buyers in the government, education and healthcare industries. They are able to provide value-added capabilities required to service their participants in ways that can often differ from traditional 401(k) participants.

Regardless of chosen strategy, participant experience will become increasingly important

We believe that a key requirement to compete in the future DC marketplace is either a scale-based competitive advantage or a specialized strategic focus within a niche market segment (plan size or plan type). However, we also think that scale or specialty alone is not sufficient to achieve long term profitability for most recordkeepers.

The winners would be those that demonstrate success in activating their participant base to engage with value-added, holistic advice services. Those services could include more effective financial planning and wellness platforms that offer personalized user experiences or comparisons to “people like you.” Or managed account platforms delivering goals-based planning and aggregating a view of a customer’s entire financial situation beyond just their retirement plan. Increasingly, firms will also provision decumulation products and services that help participants efficiently manage their assets in retirement and consider lifetime income options where necessary.

We believe that the institutional retirement industry can have a trusted first mover advantage in building relationships with a mass market customer base seeking financial guidance.

Thanks to my colleague David Mallett for contributing to this blog.