Our recently published Asia wealth management report focuses on two crucial areas for firms: relationship manager (RM) productivity, which my first blog examined; and the importance of mobile as a channel, which this blog covers.

Let’s start with a sobering finding from our research: Just 47 percent of the more than 3,521 wealth management clients we surveyed for our report across ten markets in Asia are satisfied with their firm’s mobile offering. Most of the rest are dissatisfied for a variety of reasons, such as the app lacking functions that clients want or providing functions that aren’t relevant or useful. Other issues mentioned are that the app doesn’t have support for different asset classes and tasks, is poorly designed, or doesn’t provide a direct link to their RM.

This dissatisfaction is notable because mobile is an exceedingly important channel in wealth management: Our survey found clients rank the mobile app in second place overall—just behind an online banking portal—while in five Asian markets, a mobile app even ranked first. Notably, the importance of a mobile app holds across age, wealth band, gender, and investor type, with 60-70 percent of respondents rating it as important. The only notable exception is investors aged 65+, where just 25 percent rank it as important.

Houston, we have a (budget) problem

Simply put, a mobile app is a fundamental requirement for most wealth management clients in Asia. Clients want an end-to-end mobile offering, but they aren’t getting it today—and a big reason for that is a lack of investment. Budget constraints due to a changing macro-economic environment mean many firms feel unable to improve their mobile offering at present. At the beginning of the year, half of C-suite respondents we surveyed for our report say their 2023 transformation budget hadn’t increased; for the rest, their transformation budget had as much as halved. Additionally, there is now competition for those limited funds, which need to be spent on a range of back-, middle-, and front-office functions.

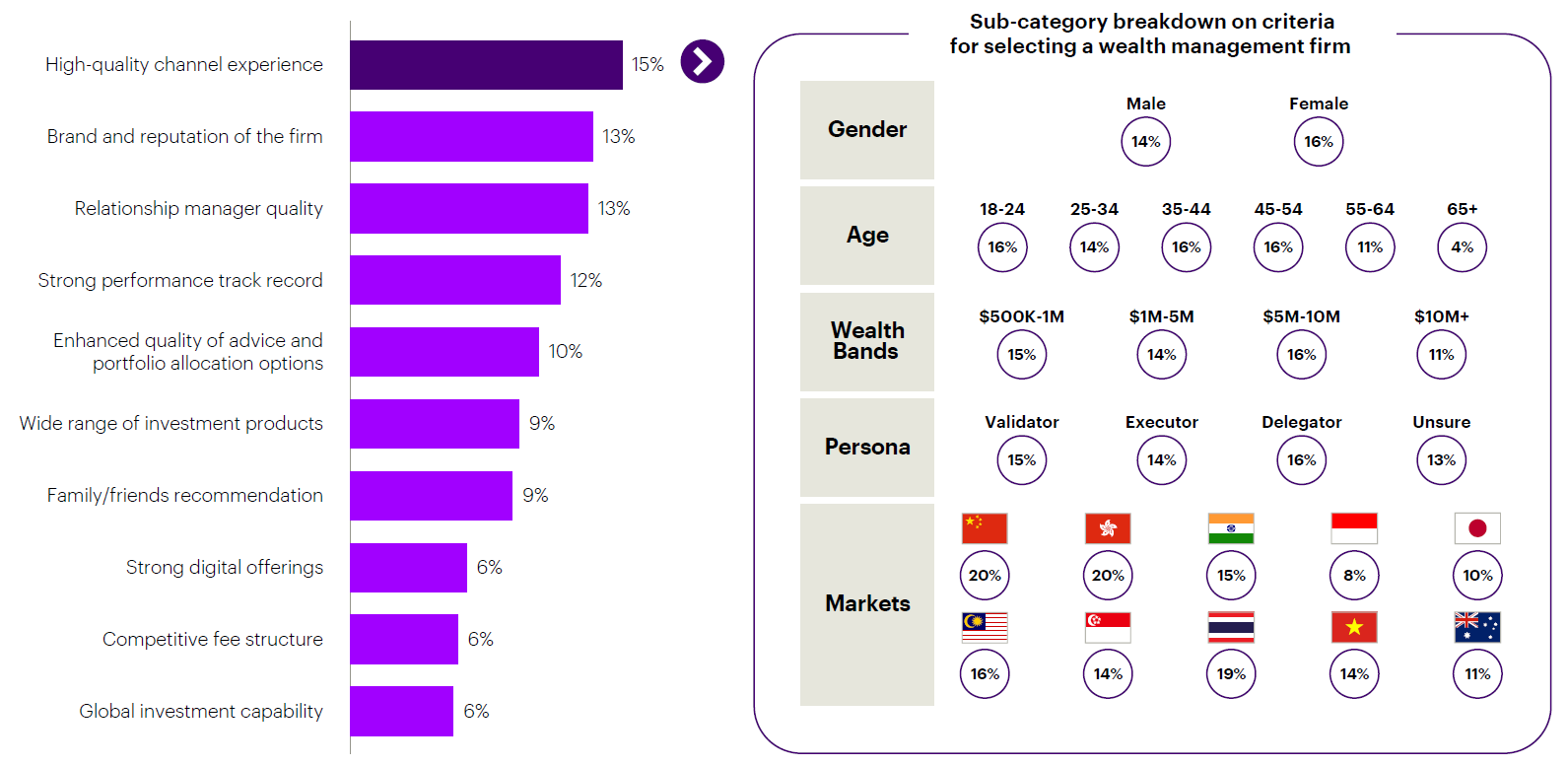

But if a better mobile app looks like wishful thinking, it shouldn’t. When we asked clients to tell us why they selected the wealth management firm they use, the leading answer was the existence of a high-quality channel experience (see graph below). This comes ahead of the firm’s reputation and track record, the quality of their relationship manager, and even the recommendations of their family and friends.

The importance of a high-quality channel experience

The mobile channel experience, then, is fundamentally important to clients—and firms that fix this part of their offering stand a far better chance of attracting new clients while retaining and deepening their relationship with existing clients. As a proof point, we compared for our report the mobile offerings of two private banks: Private Bank A’s mobile satisfaction rate was an impressive 72 percent, the firm’s overall satisfaction rate was 63 percent, and it captured an above-average 60 percent of its clients’ AUM. For Private Bank B, mobile satisfaction was at 50 percent, its overall satisfaction rate was 35 percent, and it captured just 54 percent of its clients’ assets.

Criteria for selecting a wealth management firm

Source: Accenture’s Asia Affluent Investor Survey, Q1 2023

Towards a smooth landing: Drafting a blueprint

Knowing where mobile apps fall short and what clients want will allow firms to draw up a blueprint that could get them to their destination, which is “being regarded as my client’s primary bank”. That’s an important metric because, as our research shows, there is a direct link between client satisfaction with their primary bank and the share of client AUM held with that bank.

The good news for firms is that getting mobile right isn’t as difficult as they might imagine. Our Mobile Wealth Excellence Framework, which we outline in much more detail in our report (page 41 onwards), shows how banks could structure a mobile offering and can help map out the route forward.

Overall, firms should start by defining three scenario elements for their app: the wealth bands it’s targeting, the personas, and the focus of the core journey (digital self-serve, omni-channel, RM-assisted). Next, they need to tackle the end-to-end journey by answering five questions:

- What capabilities are needed in the app journey bearing in mind that, according to our survey, the room for greatest differentiation is in advisory?

- What asset classes should the app support?

- Where do offline omni-channel journeys intersect?

- What experience principles should be embedded in design? As the user experience is critical for adoption, aspects like personalization and performance are crucial.

- What enablers and nuances are required to complete the journey design?

There is no “right” approach—each firm will have to map its own way forward—but the aspects above are key as they could help to build an end-to-end leading mobile experience. Ultimately, the litmus test for any mobile app is the adoption rate and the question whether clients are using it or not, which means they need to be satisfied with it. Although many aren’t, growth-focused firms would be wise to use this as an opportunity to differentiate themselves.