Other parts of this series:

The wealth management opportunity in APAC is huge and growing. Rewards are likely to flow to wealth managers who realize the potential of artificial intelligence-driven personalization.

The Asia-Pacific (APAC) region is seeing a surge in investable assets, with the wealth of high-net-worth individuals growing in double-digits in some markets such as China, Taiwan and Hong Kong, and with an average growth of 7.9% regionwide.[1] However, not all the region’s wealth managers (WMs) may be lifted equally by this rising tide. I believe that one key differentiator for success could be leveraging data and artificial intelligence (AI).

Accenture research has shown that those firms that have taken a lead on AI, industrializing and centralizing AI techniques across the entire investment process, are reaping the benefits, with double the success rates and triple the returns.[2] Others may face challenges in replicating this, but the potential rewards from using AI effectively are worth the effort.

Perfecting the feed

Why is AI likely to make such a big difference in APAC? One distinctive feature of the region is a preference among clients to self-direct their own investments, unlike the discretionary mandates that are more common in the US and Europe—coupled with the likelihood to transact more frequently. In this context, relationship management has to focus more on supplying clients with research and trading advice that caters to their specific investment interests and life stages.

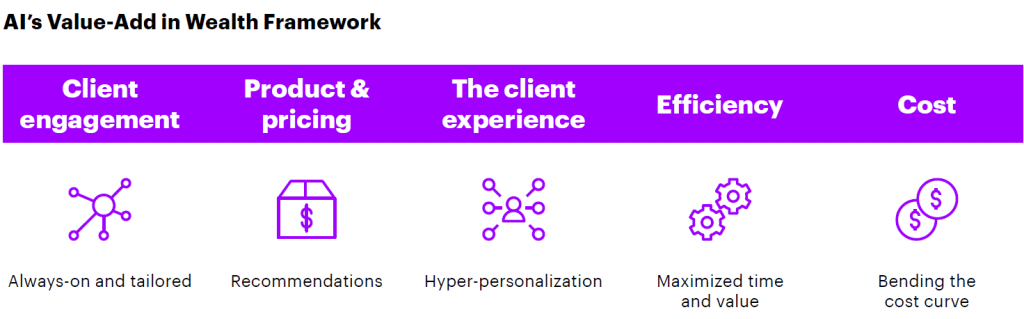

This kind of personalization is something at which AI could help excel. While AI also has a big usage potential in many back-office applications to help cut costs, its use in the front office could have a dramatic impact on revenue. With information about a client’s current investment interests and holdings, an AI-enabled app could not only share relevant in-house research with them but also sift unstructured online news and investor reports for actionable intelligence. Recommendations can then be checked by a relationship-manager and rapidly disseminated to clients. AI’s scalability is hence a golden ticket to better lead-development and client retention.

This kind of technology-enabled solution is especially critical in APAC, where a generation of family offices are handing over assets from retiring Baby Boomer industrialists to a new generation of tech-savvy Gen X and Millennial leaders, and to female family members who in many cases will take on vital leadership roles. Who best caters to the needs of this new generation of leaders would determine which wealth managers can benefit from the generational succession in the region.

Playing catch-up

In APAC, several banks have been leading the AI charge. Examples include UBS Global Wealth Management leveraging AI to offer actionable insights and trading cases to clients in APAC.[3], [4]Credit Suisse has rolled out AI capabilities for its relationship managers to provide relevant, actionable insights, and is looking to increase its data and AI capabilities further to deliver hyper-personalized service to its clients.[5] Standard Chartered’s automated, algorithm-based Personalized Investment Ideas tool is designed to provide its priority banking clients what it calls a “digital with human touch experience”, allowing relationship managers to generate and instantly distribute personalized advice based on clients’ risk profile and the bank’s market views.[6] Japan’s MUFG intends to launch a Next Best Action (NBA) digital platform for wealth management in mid-2021.[7]

Despite these advances, many APAC wealth managers are lagging somewhat behind, at least in comparison to the US. Regional players are mostly still in the early stages of their AI offering. Such technology has become all the more advantageous during the COVID pandemic. Disruption to normal relationship-management touchpoints such as in-person meetings and conferences has made digital closeness invaluable. Consider that in the first two months of the pandemic, Morgan Stanley’s AI-driven NBA recommendation engine was used 11 million times.[8]

AI would not replace human relationships, but rather augment them, making it easier for relationship managers to interlink all the information about a customer to provide the right recommendation at the right time using the right channel, rather than triaging by phoning the biggest and most active clients while the rest go uncontacted.

Click/tap to view a larger image.

Source: Accenture

There are some roadblocks to consider, which I will examine in more detail in my next blog post. While these should be navigated carefully, the rewards from AI adoption would in many cases much outweigh the risks for APAC wealth managers, given the critical business need to align the advantages of smart personalization with the scale of the region’s potential client base.