Over the past year, capital markets firms were understandably hyper-focused on stabilizing client relationships, guaranteeing employee safety, and keeping operations going during the economic uncertainty COVID-19 brought. Efficiency and caution ruled the day. But now we’re seeing the pendulum increasingly swing in another direction as firms think about how to accelerate growth again.

If the pandemic taught the wealth industry anything, it’s how crucial digital technologies are. Wealth management firms are diving into creating a better client and advisor experience using new capabilities powered by data and artificial intelligence (AI). Early movers mostly see today a window within which AI can be a true competitive differentiator before it becomes table stakes.

Triple the ROI when you scale AI

Accenture survey results of 100 wealth management strategy, digital and technology executives show that up to 80% report they’re either deploying or scaling both client- and advisor-facing AI-powered technology. Our experience shows it’s not atypical for a single use case to generate an up to 20%+ uplift, growing both existing clients as well as revenue from new clients. But moving beyond single use cases multiplies results; companies that are strategically scaling AI report nearly 3X the return from AI investments compared to companies pursuing siloed proof of concepts.

Where is your firm on its AI funding journey?

Despite such statistics, gaining approvals to fund AI projects (particularly at scale) can be challenging because the business case and ROI equation for AI implementation are very different from those of many traditional technologies. As you vie for funding, there is no one-size-fits-all solution. Proceeding wisely also looks different depending on where you are in your AI journey.

Most often it is likely to be your organization’s context and data—used to train, test and refine the AI model—that will help ultimately shape the ROI equation. This differs markedly from traditional hardware or software investments where the costs and impacts are more neatly defined and predictable.

We therefore thought it might be helpful to lay out in this blog some of the funding considerations for the different stages of the AI journey.

If you are at ground level: Yet to begin the AI journey

At ground level, you need to first think about what actions and foundational projects will show that crucial first wave of value. Target your ask specifically to a portfolio of projects that will show value over the next one to two years. Then further refine that list to those that have executive sponsorship and be clear about the enablers you need for success (data quality and access, cloud architecture, agile operating model, etc.).

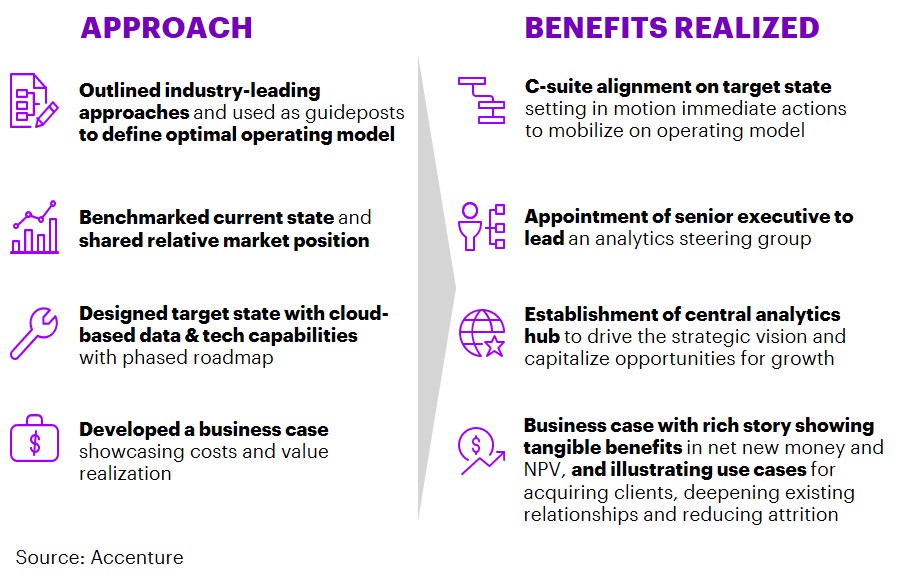

Don’t forget to build governance and risk management in from the start. Data and analytics, as well as your firm’s underlying technology architecture come to the fore when you add AI to your client strategies. For example, consider how we helped a large wealth manager with a recent data and analytics strategy assessment:

Benefits realized from a data and analytics assessment

When you are mid-journey with some investments already made

Mid-journey, you should have a successful pilot and some quick wins already. At least one of those projects needs then to show tangible value. Think carefully about the funding you need to get to that value.

Don’t forget to nurture organizational buy-in as you go: AI is ongoing and iterative. It’s not enough to have executive sponsorship; you need buy-in throughout all levels and teams to achieve the culture and behavioral changes necessary for humans and AI to work well together. Your workforce needs to learn the skills necessary—with training provided or curated by your firm—for AI to show full value. Adoption is key for continuity, scaling and ongoing innovation. The most common funding requests to achieve this buy-in should center on training, cross-functional collaboration, and redesigning workflows to build in data or architecture that allows rapid scaling from pilot to full-scale use.

Advanced level AI: Keeping it relevant for clients

When you’ve mastered AI elementals and are looking to take funding and results to the next phase, it’s time to explore new use cases. But to do that successfully, you need to show sponsorship and an end-to-end value case.

A strong business case, at this advanced level, could be about showing how to take AI to the next level to cut across different silos and add more customer value. This could be moving from 1-2 use cases that have achieved strong value to a broader portfolio touching many areas – such as multiple geographies or internal business owners.

In tandem, you should determine how to get approval for setting up a more formal AI group and structure, with an increasing number of dedicated resources. You also need to examine the right balance and interactions between ongoing central support and the continual embedding of AI within business units. All of this while maintaining strong collaboration and a united focus on the overall strategic vision and business priorities.

It’s not just about being new and innovative—it’s also about how to maintain client relevance over time. We’ve recently helped clients tackle some of these questions. We helped a bank devise a plan using AI to help them achieve a cloud-based 360-degree view of their clients so they could work on gaining more business from their existing base. We have also helped another large bank use AI for digital targeting, using first- and third-party data to drive intelligent new client acquisition.

You’re not alone

You’re not alone in funding challenges when it comes to AI. But the good news in our experience is, most executive leadership are also more educated on AI and its value. They’re generally on board but are looking for you to make a business case for the right value at the right time, in a targeted way.

We’ve helped many clients develop the right storyline for specific situations where AI can help the business with its larger goals. Let us know if you’d like to have a conversation on how to fund your AI journey with us.