Truth be told, I’m up late working on this blog. I’d like to say it’s because I’m extremely busy with clients—and I am—but honestly, it’s my own wealth management needs that are at the forefront. With a new baby arriving just before the pandemic and a 4-year old growing fast, retirement, 529 plans and a shifting appetite for portfolio risk are suddenly more than just an academic exercise.

It’s timely, then, that Accenture’s 2020 financial advisor research—Financial Advice Reimagined—is on my desk. We recently surveyed 200 financial advisors across North America to determine how they are meeting client needs. I won’t subject you to the reams of data I’m looking at, I promise. Instead, let me summarize three key themes that came across loud and clear.

#1 Advice must be holistic.

Clients are increasingly using their financial advisors as everything from a life coach to a therapist. It’s not enough to be a good portfolio manager anymore. Managing wealth has become more personal and complex as the world and our choices have become more complicated.

For instance, eight out of 10 advisors (81%) we surveyed said they hold meetings to help clients navigate complicated family dynamics. Clients will continue to rely on their advisors more to help navigate difficult conversations, such as prescribing inheritances that are “fair” versus “equal” and explaining the responsibility of wealth to the next generation.

#2 Advice must be on demand.

We live in an on-demand world, and client expectations for wealth managers have followed suit. Experiential demands from Ultra High Net Worth to Retail segments blur with the convenience services they use every day, like DoorDash or Lyft.

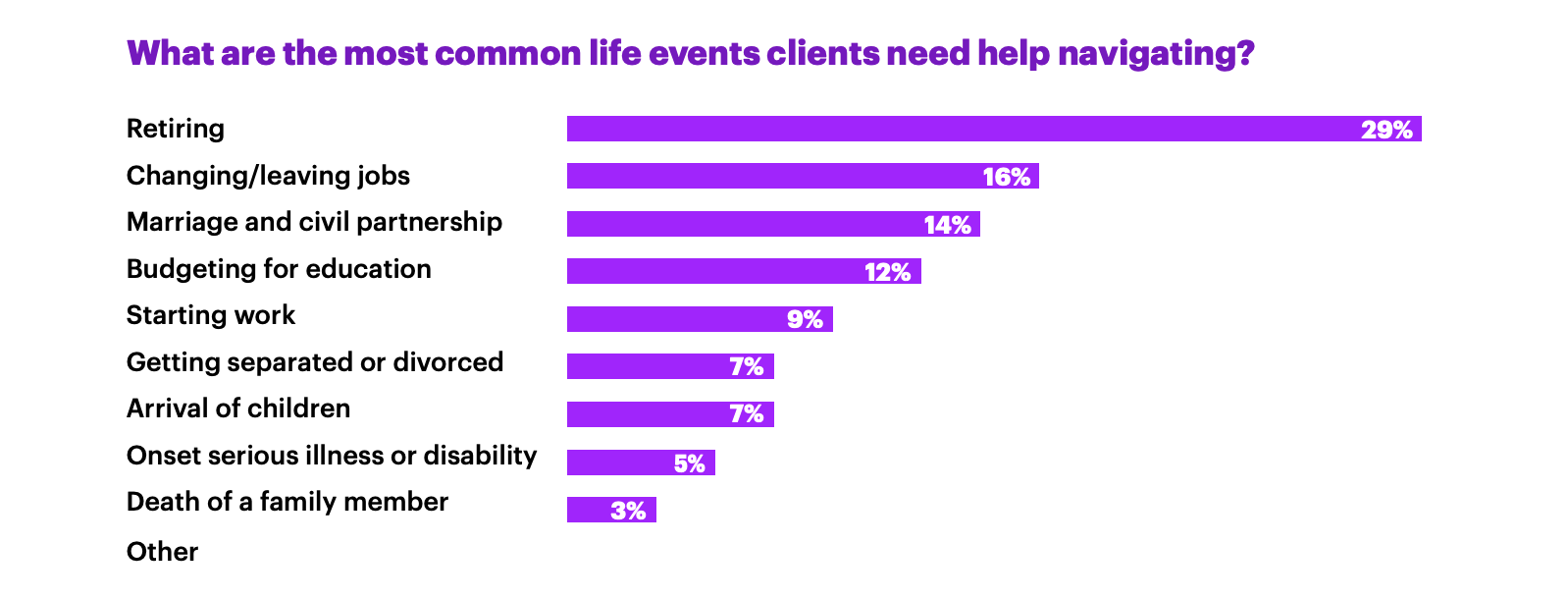

Our research shows that clients are seeking advice for a variety of life events, most of which happen in between the standard quarterly touchpoints with their wealth advisor.

Source: Accenture

Most of these advice events can be reasonably predicted, yet only 8% of financial advisors report meeting with their clients on an ad-hoc basis. Firms have invested in on-demand capabilities, but this will require a committed shift across advisor sales service practices, data use and technology investment to deliver advice when clients need it.

#3 Advice must be integrated.

COVID-19 has accelerated the disruption in how advice is given. Even pre-pandemic, less than half (45%) of clients met with clients in person most often. We have seen a massive shift to virtual engagement that clients tell us will not go away in the future and will only grow.

No situation is static, so financial advisors must increase their comfort with all types of digital communication. The wealth managers who reap the most benefits beyond COVID-19 will be those that move from digital communication to digital collaboration. Clients expect that in the future, they are offered holistic advice in an integrated way.

And don’t forget . . . clients want to do good while doing well

Sustainable, ethical investing is currently outperforming traditional funds. Socially conscious investing is here to stay, driven increasingly by a younger generation that wants the impact on their wallet to also have a positive impact on the world. Three out of four advisors regularly address questions on Environmental, Social and Governance (ESG) investing.

Sustainable, ethical investing is currently outperforming traditional funds. Socially conscious investing is here to stay, driven increasingly by a younger generation that wants the impact on their wallet to also have a positive impact on the world. Three out of four advisors regularly address questions on Environmental, Social and Governance (ESG) investing.

As we continue through a year that has been anything but certain in so many areas, providing the experience your clients want becomes more important than ever. Financial advisors have a central role in unburdening the financial stress for the households they serve. I’m sure I’m not the only one losing sleep at night trying to plan for my family’s future. And I really love being in a business that can help people avoid that very thing.

If you’d like to learn more about our financial advisor survey results, visit Financial Advice Reimagined. And if you want to discuss in more depth how your firm can enable a better experience with digital technologies, please email me. That’s a conversation I’d enjoy.