With holistic advice fast becoming the norm, most financial advisors today know their clients better than ever before. And they have to in order to provide the best financial advice possible for a wide variety of life goals.

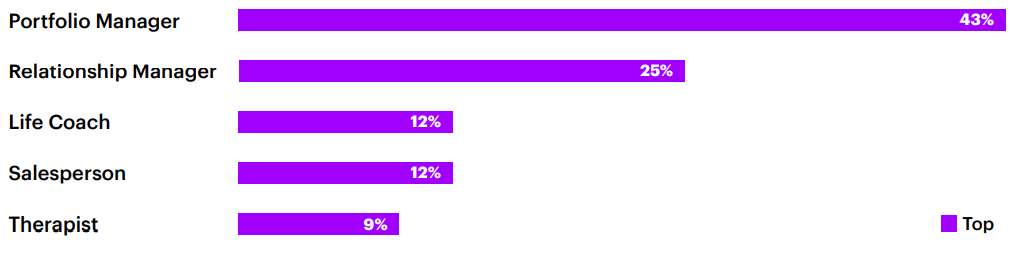

When I ask advisors if they have a “typical” client, they generally say they don’t. Advisors today are all dealing with an ever-changing set of client and family needs. And the current shift to holistic financial advice also requires advisors to fulfill a variety of roles. Advisors still spend more time on portfolio management than anything else, according to our recent Financial Advice Reimagined research, but other roles can’t be neglected.

Financial advisors rank roles based on time spent

Source: Accenture

As the shift to holistic advice takes hold, flexibility in products and services also becomes more important. In our recent survey, roughly nine out of 10 financial advisors (87%) told us they use complex models to allocate capital among a wide variety of asset classes, from mutual funds to insurance for their clients.

With financial advisors tasked with wearing many more hats, they need increased options from their firms so they can meet a deeper, broader set of client needs.

Increased competition and partnerships

Banks, insurers and platform providers are turning up the heat, innovating with new products and broadening their reach into consumers’ financial lives. For example, PNC, the sixth largest commercial bank in the United States, partnered to incorporate life insurance offerings for their wealth advisors.

If wealth managers want to entice new clients and better serve existing investors to retain them, they’ll need to have access to an array of financial options. For some firms, that means organically growing a new or additional capability. But for the majority, it will mean partnering or adding a capability through an acquisition. That requires strategic decisions sooner rather than later. Maybe it means your firm outsources investments but specializes in managing the holistic client relationship. Or, maybe your strength is portfolio management but estate planning is done through a trusted partner. Whatever the arrangement, ensuring a full cadre of options for your clients is a competitive advantage you don’t want to miss.

Why one-stop shopping is becoming essential

When I think about the trend toward holistic advice, I think of my brother. Recently married with a new job and a new home, he is experiencing the increased financial complexity that comes for most of us as we age. As he and his spouse plan for children, he is realizing that the self-service digital offerings that previously seemed to satisfy his financial needs just can’t account for the many moving parts of his new life—at least, not to his satisfaction.

My brother’s reaction supports another finding from our research: 81% of advisors said they hold meetings to help clients navigate complicated family dynamics. Most investors today want a mix of digital and human advice, biasing toward humans for more nuanced, complex situations.

Whether planning their estate or saving for college costs, buying insurance or investing in the right asset classes, clients want fewer touchpoints to manage. Being able to go to one firm that knows their goals, their assets, their family needs and more would be a welcome relief. Reducing financial stress and complexity matters.

I recently had the pleasure of serving on an Aite Group Executive Forum panel addressing the role of portfolio management in an advice-driven market. I made many of the same points I’ve just made here—no one role or capability is the winning formula anymore. Excellence across the board matters, but whether that excellence is “homegrown” or outsourced matters less and less. The breadth, depth and innovation built into your firm’s products and services has become essential for success—but there are many ways to get to the end goal.

As always, I’m happy to discuss how to achieve success and better serve your wealth management clients’ needs. It’s an exciting time to be in the business and a crucial time to be moving your company’s capabilities forward.