Together with a group of our industry experts, we have developed and published our Capital Markets Industry Vision for 2025. Grounded in an analysis of the financial results of over 140 capital markets firms for 2020, it describes what we see playing out over the next several years and more importantly what we think companies could do both in the short and medium-term in return.

Based on current industry, economic and technology trends, our publication covers the sell-side, the buy-side and the market infrastructure for the capital markets industry. Visit our page and download the full version of the paper, but I’ll summarize it briefly here for a speed read.

Stability and flexibility in uncertain times

The pandemic has had a terrible impact on humanity and many sectors of the global economy have been severely impacted. Capital markets firms have played a key role in helping to stabilize the global economy and going forward, it would be vital that banks, asset managers and investors continue to provide funding and liquidity to ensure that credit markets are functioning.

Capital markets firms will also need to be flexible and embrace change. For many banks and financial institutions, their relative strength today, compared with the 2008 financial crisis, presents them with a unique opportunity to accelerate investments in new technologies and new ways of working: from cloud to artificial intelligence, we believe now is the time to prepare businesses for the next wave of disruption that could come to the sector in the next years. As the global economy emerges from the pandemic, capital markets will be fundamental to ensuring that capital flows resume, and the recovery takes off.

But let´s look into the Capital Markets sectors in more detail:

Sell-Side: Investment Banking

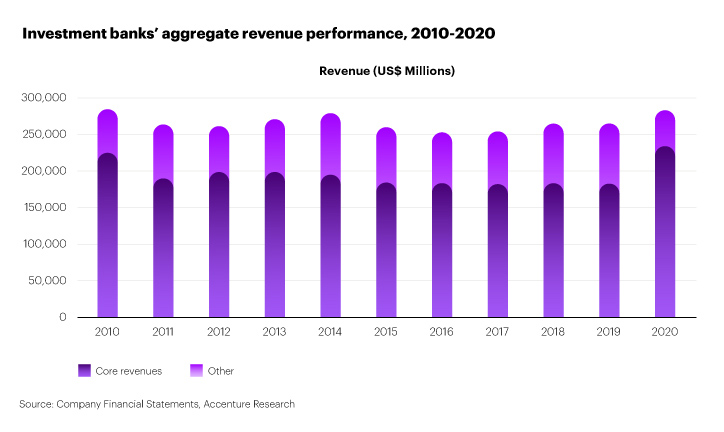

Investment banks core revenues rose by over $45 billion from 2019 to 2020 according to our analysis, which we believe gives companies the opportunity to invest in their transformation journeys. Through 2025, investment banks could work toward further revenue growth by treating both people and technology as key drivers of success.

In the short term, they’ll have to work to bend the cost curve by rebuilding around their core and using artificial intelligence (AI), machine learning (ML), Software-as-a-Service (SaaS) and Development Operations (DevOps) to their fullest extent. In the medium term, they could enhance the client experience, risk management and capital allocation discipline, in part by redesigning their operating model to better team their people with advanced technology.

Buy-Side: Asset & Wealth Management, Private Markets

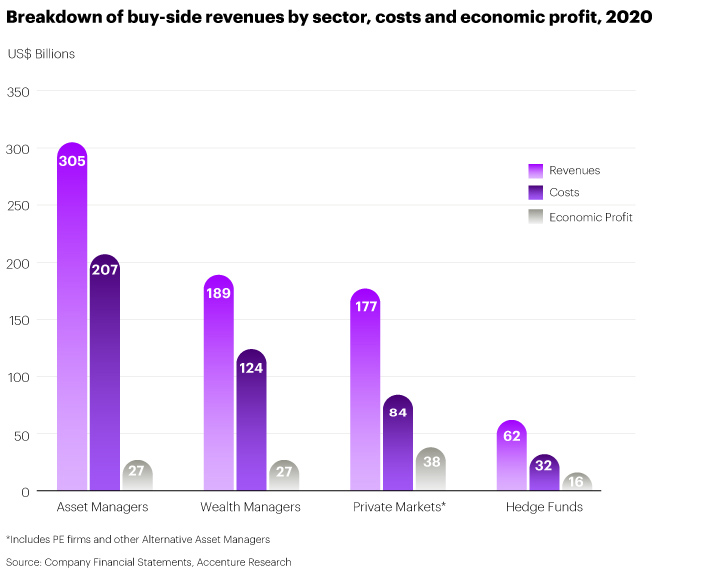

As stewards of capital for clients of all types and size, buy-side firms continue to face a host of challenges across the investment and client landscape. In asset management, it means confronting decoupling assets under management and revenue growth; in wealth management, it’s a story of next generation client engagement; and in the private markets, it’s becoming as operationally efficient and technical accurate as possible.

In the short term, asset managers may need to look beyond traditional cost levers to find new ways of working and delivering results, likely using cutting-edge AI, data and analytics to spur that innovation. In the medium term, we see them looking to digitize their operating model to become data driven from the core, with data insights powering decision making.

With wealth advice and products increasingly democratized, wealth managers in the short term will focus on their core value proposition. Many will need to refresh the client-advisor engagement model by keeping the client at the core—not the other way around. In the medium term, they will mix automation and talent to deliver far more personalized client services across all customer segments.

To stand out in an increasingly crowded and competitive marketplace, private markets firms would need to become digitally enabled across the firm as well as the holding and portfolio companies. Short term, that could mean focusing on specialized platforms that help provide an end-to-end view of the investment lifecycle. In the medium term, they would need to balance multiple platforms, aggregating data between them for seamless integration.

Financial Market Infrastructure: Exchanges and Asset Servicing

It’s possible that in 2025, we might already see the first fully automated digital exchanges, with full automation throughout the technology stack, with tokenization using blockchain. That means forward-looking exchanges will have their data houses in order by then, making efficient use of cloud, AI and advanced analytics. In the medium term, exchanges could embrace new product opportunities, such as new asset classes like environmental-benefit linked securities.

Asset servicing firms could move from post-trade services like clearing and settlement to also offer digital asset custody services. In the short term, that means they will have to map out their path to becoming digital entities. In the medium term, they would be creating the enterprise-grade infrastructure necessary that underlies digital assets securely.

Positioning for success in 2025

In capital markets, business strategy and technology strategy are converging. How well capital markets firms plan for and execute this merger will be critical to success in 2025 and beyond. While each industry sector is unique, Accenture’s 2025 vision for capital market points to a few key actions that could help financial firms position themselves for the future:

- Conduct a forensic review of the current restructuring agenda, including evolving priorities and competitive landscapes.

- Become a “cloud first” business. This is not just about improving efficiency; it’s about enhancing flexibility, capability and agility.

- Embrace emerging technologies for their potential cost benefits and revenue opportunities.

- Position your firm to secure the right people and skills in an increasingly competitive market for talent.

- On a firm-wide level, focus on getting both the client and the employee experience right alike.

If you’d like to talk about how your firm can get there, I’d welcome the conversation.