Since the 2008 financial crisis, derivatives have been in the regulatory spotlight. One of the dedicated protective rules that was introduced in 2016 was around the need to post risk-based initial margin into segregated accounts for uncleared derivatives. This requirement will continue to be phased in through 2021.

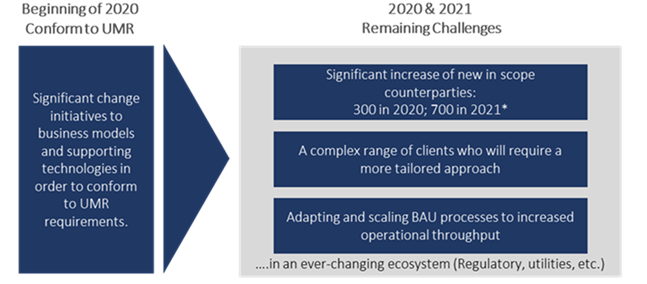

In order to conform with these uncleared margin rules (UMR) requirements, most of the largest broker dealers have already made significant changes to both their business models and supporting technology. Despite this sizeable undertaking in the industry, challenges remain even for players who are already adhering to UMR. Over the next two years, upcoming additional phases of the regulation will continue to force the broker dealer community to adapt further.

Expanding Uncleared Margin Rules in 2020 and Beyond

Source: Accenture

* https://www.trioptima.com/triresolve/collateral-management/initial-margin/

In order to cope with these upcoming challenges, Accenture recommends a scalable and formalized approach: If firms haven’t already, they should start considering changes to their business models and supporting technologies. By September 2020, an estimated 300 more firms will be subject to the new rules – joined in September 2021 by another 700 companies. This expanded scope of counterparties will lead to new challenges that require continued attention to this topic.

Challenge 1: Preparing your clients to exchange initial margin

With more firms coming under scope for the mandatory exchange of initial margin, this will naturally create a strain on both broker dealer and custodian onboarding capacity. For firms with a high volume of counterparties, this challenge will be magnified even more.

Onboarding efforts will likely intensify towards the September 2020 milestone. This is caused by counterparties approaching this documentation and operational requirement for the first time against aggressive timelines.

Challenge 2: Meeting the needs of complex clients who will expect a more tailored approach

For some buy side firms, there will be unique requirements for initial margin processing, including bespoke Credit Support Annex (CSA) requirements, calculation methodologies and eligible collateral preferences. Additionally, many broker dealers may feel an increased need to enhance their UMR product offering in order to retain and increase their wallet share from more demanding clients.

Challenge 3: Adapting to increased operational throughput as business as usual

Business as usual (BAU) will no longer be business as usual. The increase of UMR counterparties will require a front-to-back review of the existing infrastructure to accommodate an uptick in the volume and complexity of BAU processing. Further, the change creates a new impetus to optimize and solve for pain points, such as disputes, settlements, exceptions and reporting.

To complicate matters further, all three of these challenges are up against the backdrop of an ever-changing ecosystem, including the refinement of regulatory requirements and rapidly changing market conditions.

Ways to Overcome UMR Challenges

There are a number of efforts firms can undertake to address these challenges. To start, firms should scale their onboarding process, including testing capabilities for the counterparties that will be newly in scope by September 2020.

With this in mind, firms should focus on implementing a client-centric approach to meet the needs of their customers in a way that doesn’t impede regulatory compliance. And finally, firms would need to enhance their existing business processes and related systems in order to manage scalability and support the more unique requirements of new counterparties, all while refining their client offerings.

Of course, all of these challenges should be addressed while considering cost.

Uncleared margin rules are an important regulatory step following the 2008 financial crisis. The first phases have already been a significant undertaking for the industry; 2020 and 2021 will require a different focus and approach. While challenges are complex, starting early and being aware of all the details could be key to successfully transforming a firm’s UMR capabilities and offerings.

Please reach out to me at michael.cheek@accenture.com if you want to discuss how you might best prepare your organization for the next phases of uncleared margin rules.

And special thanks to Benedikt Seelhorst for his contributions to this blog.